“Long ago I stopped looking at this game the way I did when I worked for a publisher who gave me a fixed budget to make a retail game.” – Chris Roberts, 2014

“Long ago I stopped looking at this game the way I did when I worked for a publisher who gave me a fixed budget to make a retail game. I now look at our monthly fundraising and use that to set the amount of resources being used to develop this game. We keep a healthy cash reserve so that if funding stopped tomorrow we would still be able to deliver Star Citizen (not quite to the current level of ambition, but well above what was planned in Oct 2012)” – Chris Roberts, Sept 30th, 2014 (Letter From The Chairman)

THE STAR CITIZEN PROJECT IS IN FINANCIAL TROUBLE

After raising over $150 million in crowd-funding, plus unknown investor amounts and bank loans, on June 13th, 2017, CIG/RSI took out a high-risk loan secured by all the assets backers had poured money into, over a five year period.

As I have reported in the past, for some time now sources have informed me that the project was in financial dire straits. Despite denials from some in the toxic backer community, and silence from CIG/RSI – even though they had pledged to provide financials to backers – their recent 2016 financials filing in the UK, had some curious entries which served to support this notion.

But before I get into that, I want to point out that as far back as 2015 when various sources (past and present), informed myself and indeed various news (e.g. The Escapist, Kotaku UK etc) outlets of the project’s financial problems, they were estimated to have roughly 90 days worth of funding. As with anything related to analysis, that’s the info that was available at the time. However, since that time (and you can see this from the funding metrics), a set of whales clearly stuck in “Sunk Cost Fallacy” – as well as those who are using the project as a money laundromat – have been steadily putting money into the project in order to prop it up. This despite the fact that, by all accounts, the project is now a complete failure, and stands zero chance of ever being completed, let alone as was pitched back in Nov 2012. As I wrote in both my Oct 2016 Shattered Dreams and Dec 2016 Irreconcilable Differences blogs, following blatant lies from Chris Roberts at both GameCom 2016 and CitizenCon 2016, the signs were already there – in plain view. But only if you were paying attention.

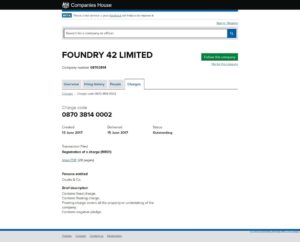

As CIG and RSI are private US companies, backers have no way to gain access to their financials (as was promised), without filing a lawsuit (it will probably get kicked into arbitration). However, as the largest studio (in what is a string of 15 corporate entities), Foundry 42 in the UK, is the current conduit to their financial picture in some regard. On June 12th, I wrote an analysis of their 2016 filing. That filing showed, as had previously been speculated these past years, that they had to be burning no less than $3m per month funding this project across five (there are now two in the UK) studios. One thing that stuck out was a curious restatement in Section 19, which I pointed out:

“Section 19 is very curious. Due to the huge restated amount of £2.4m ($3.0m) from 2015, it reads like the sort of thing that would result from either a govt audit, or them just cleaning up their books in order to pass any due diligence muster. Also, as they’re now taking tax credits, it makes sense that these sort of numbers should be devoid of any such discrepancies, or they would also be in some serious problems with the govt. If you look at the chart from the previous analysis, with these restated numbers, it is now also clear that though the company doesn’t sell anything, they’re using money received from the parent (the backer piggy bank) company, as their income/turnover cash flow.”

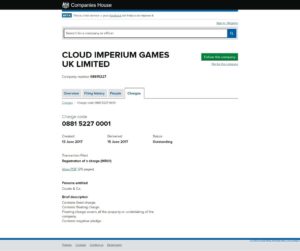

Well, I was right (again). Following that June 9th filing (which as I noted, was early this year, seeing as they traditionally filed late, while paying fines), they filed a charge (aka loan) on June 13th. This charges means that, in addition to a previous NatWest Bank loan from Jan 2015, they just took out another bank loan, this time through Coutts & Co (fined in 2012 by UK authorities , in 2016 by Asian authorities, and in 2017 by the Swiss authorities over money laundering) which, along with NatWest, is owned (1, 2) by RBS. This would explain why they needed to “clean” their books, and this discrepancy was probably flagged as part of the due diligence the bank had to do in order to grant this loan.

“It all started when I wrote a blog about my concerns back in July 2015. It went downhill from there. Rather rapidly.” – Derek Smart, Aug 15, 2015 (Star Citizen – How I got involved)

The end result is that, even after supposedly raising over $152 million from backers, they now have two (Foundry 42, Cloud Imperium Games) bank loans which they have to carry on their books, and which have to be paid each month from backer funds, seeing as the company has no other source of revenue.

And we still don’t know how many loans – if any – the US based entities have on their books, which, in addition to investor money, is probably why they are now cash strapped and need to continue taking loans to make payments on current loans, while trying to stay afloat.

“First of all, we always have a decent amount of money in reserve, so if all support would collapse, we would not suddenly be incapacitated. We plan the scope of the development based on what arrives monthly by the people to support. I’m not worried, because even if no money came in, we would have sufficient funds to complete Squadron 42. The revenue from this could in-turn be used for the completion of Star Citizen.” – Chris Roberts, Jan 14th, 2017 (GameStar)

Aside from that, these loans – especially this second one – ensure that if they were to default, or the company goes bust, all the secured assets (IP rights, assets including art, music etc, hardware, office equipment, as well as tax credits, third-party agreements etc) related to the project, all belong to the bank being first in line. Backers and investors stand to lose everything.

This needs to be stressed:

I don’t care how they spin this, or what backers choose to believe, this is a very – very – bad and eye opening event that just happened. If the largest studio associated with this project now has two loans – secured against all its worldwide assets – and tied to the parent holding company (hence the two charges), it stands to reason that the US parent company 1) can’t secure additional investors, which is always preferable to taking out secured loans 2) is probably either saddled with a pre-existing debt load, or it can’t get a loan – or it would have taken out the loan, then continued to fund the studios as it has been doing (as per the UK financials).

It also means that with a $152 million liability (to backers) for products they have yet to deliver, whatever this loan is, couldn’t be any substantial amount or it won’t have been taken through a subsidiary company that has no tangible assets (other than hardware, furniture etc) or income (it is funded by the US parent – as a separate studio).

So, a crowd-funded project that, back in 2012, needed $5 million, now six years later has burned through $152 million (assuming the funding chart is accurate) in backer money, plus investor money, and now has bank loans on top of that.

And there are now two loans in the UK alone. Which means that this second loan wasn’t big enough to pay off the first loan. Which invariably means that they need both loans. And they can’t take out any more loans because the second loan has now tied up ALL the company IP and assets as security (see p3 Section 4 of the filing).

They have failed to ship ANY project, even after raising ALL this money. And there is NOTHING that currently shows that they can do it even if they raised another $150 million.

The fact that they are taking out secured loans, means that backer funding is insufficient to continue operations. So that means they now rely on that same backer funding to not only fund operations, but to also pay these debts. So how are they going to do that in the long term, now that they are saddled with debt, for a project that was said to be fully funded.

So instead of being accountable to a publisher, or to backers who funded them, they are now accountable to investors and bankers. And these banks now own ALL of the CIG/RSI assets, of which the Star Citizen IP is the primary and most valuable – if they ever complete (they won’t) the project.

And worse, according to p16 Section 24, the bank now basically owns both Star Citizen and Squadron 42, and gives CIG/RSI permission to continue to develop and sell the games. This is revoked if CIG/RSI goes 60 days without paying their loan.

They’re screwed. It really is that simple. As are backers who forked out over $150 million, only to see CIG run out of money, then turn around and take out loans against the projects. So if CIG defaults (or decides to walk away), the bank owns everything; while not carrying the $150+ million liability that CIG owes to backers who funded (pre-paid the project).

This is like Freelancer all over again. Microsoft bought Digital Anvil. Chris failed. Microsoft kicked him out and took over the project.

It has to be stated that this loan could very well be used to wind down operations in the short-term, pay out bonuses, and Golden parachutes etc, for Chris Roberts’ friends and family who have unjustly enriched themselves from backer and investor money. Then they default on the loan, wind down the companies – and walk away.

“In the old model as a developer I would have captured 20 cents on the dollar,” Roberts said. “Ultimately that means I can make the same game for a fifth of the revenue, a fifth of the sales, and I can be more profitable, and I can exist on lower unit sales. I think that’s good for gamers, because crowdfunding and digital distribution are enabling more nichey stuff to be viable. It’s also allowing gamers to have their voice heard, and have their influence earlier in the process. You don’t really have your input into how Call of Duty’s being made.” – Chris Roberts, April 23, 2013 (gamesindustry.biz)

If responsible backers and investors don’t start screaming (they will need attorneys for this) at CIG and holding them to the ToS which promised the release of financials, then they only have themselves to blame for the end result.

“But if you like our ambition and want to support further, if you think it is a worthy cause, if you want to make sure that all the features we are working on are given the time to be built right, then contribute how you feel comfortable.” – Chris Roberts pleads for more money, April 2017

This is a developing story. Several sources have reach out to me regarding other events which are currently playing out, including the departure (some were reported recently) of key personnel, the state of both Star Citizen & Squadron 42 projects etc. I will update this blog as-needed. You can read some of the media reports (1, 2, 3, 4, 5, 6, 7, 8) that are now appearing online.

Guard Frequency, a Star Citizen podcast, also has their take on this, and which features an ex- Coutts banker, as well as an attorney. Listen to “Episode 174 | It’s not Rocket Finance” starting at the 08:00 mark. A post-show comment :

“Their analysis appears to be factual and fair. The one point of discussion I have with their Podcast is that the UK entity will never realize a profit or pay tax, assuming the project is ultimately successful.

The UK follows OECD Transfer Pricing Guidelines (BNA Portfolio 6975-1st). Transfer pricing is essentially a mechanism that attempts to create an arm’s length economic fiction between international entities with common ownership or control. Two major abuses of this paradigm involve debt and/or intangibles (if you see Ortwin at Citcon or whatever they call it, tell him the jig is almost up on this strategy 😉 ). However, a major overhaul is underway to remedy the problem of Base Erosion and Profit Shifting (‘BEPS’) targeting these abuses. The software development credit they claim is at the local level (Manchester), but transfer pricing is at the national/international level. At some point, they will need to ‘mark up’ the value of the services their UK entity has rendered and at which point the UK enitity realizes a profit to be in compliance with these rules – unless the whole thing falls apart, resulting in both an economic and tax loss (defined as revenue less broadly defined development costs).“

UPDATE: 06/30/17:

I wrote a separate article explaining why I believe that Coutts bank also has a controlling interest in Star Citizen, and not just Squadron 42.

UPDATE: 06/28/17:

I ran through this with an attorney who deals with IP law, as well as another that works for a bank on software company acquisitions, loans etc. The main issue of contention and ambiguity are: does Coutts Bank now own Squadron 42 and/or Star Citizen, and is Star Citizen excluded from the security pledge?

As the bank isn’t a publisher, the word “ownership” is tenuous in this regard. Fact is that, the bank has a “controlling interest” in Squadron 42 (which we assumed to be the “Game” defined in the charge), and in so doing, also has some interests in various aspects of Star Citizen. If this were a publisher, such an interest would give them the means to exercise various types of actions (e.g. design input, marketing, distribution etc) in exploiting the property. But the bank, while having this same insight, isn’t likely to exercise it because, well, they are bankers, not publishers or game developers.

Instead, the bank has i) secured the aforementioned aspects, while giving to the studio, the rights to continue working on, and exploiting the product as they have been doing ii) excluded specific (the ambiguous part) aspects of Star Citizen.

For this to be a bit clearer, we have to take a close look at the these two definitions which appear on p22 – 23 of the PDF filing (29 page image album).

Collateral means the Chargor’s right, title and interest in and to (i) the property charged pursuant to Clauses 4.1 and 4.2 hereof and (ii) the property assigned pursuant to Clause 5 hereof; excluding in all cases the Excluded Collateral;

Excluded Collateral means (i) the assets that have been charged pursuant to the Nat West Security Agreement; and (ii) all Intellectual Property Rights and all exploitation and distribution and other rights and all title, interest and materials with respect to the video game provisionally entitled “Star Citizen”;

We also have to look at sections 4.2.2 and 4.2.5 on p7 of the PDF filing.

4.2.2 the Game Assets and the Distribution Rights

4.2.5 all digital material and sound and visual material made or to be made incorporating or reproducing all or any part of the Game

The ambiguity (to those who don’t know software development, or that Squadron 42 is built from Star Citizen code, engine, assets etc) is in whether or not Star Citizen is really excluded in toto from the “Collateral”. It is, but only certain aspects (e.g. the name) of it. In Section 4.2.5 “digital material” is blanket coverage of everything digital, which includes source code. Since Squadron 42 uses engine code and other assets from Star Citizen, it stands to reason that those assets are also secured.

And this is how all Star Citizen tech and assets came to be inadvertently secured in this Charge. Of course if they don’t default on the loan, or go bust at some point in time, none of this matters because then there won’t be any dispute (with the bank) as to how much of Star Citizen is contained in Squadron 42.

UPDATE: 06/26/17:

1) Since this news broke over the weekend, I have had several discussions with various sources, including industry people at other studios who have first hand knowledge of how these tax credits are leveraged, the risks studios take in relying (see 38 Studios collapse) on them, as well as why a company borrowing against future tax credits – not knowing what they would actually be – is a sign of desperation. A few bankers also chimed in directly to me, and on social media, expressing why they view this as a bad loan, given the conditions and “broad” collateral.

The general consensus is the same. This was a very bad and desperate move to make. Several sources said that it has been known for some time now that they were spending more than the crowd-funding (only source of income) was bringing in, and that the project’s over-scope and promises they have to keep to avoid legal liability, is what has doomed the projects. They also say that with several execs having already “cashed out” (e.g. see this 10/08/2015 filing), the excessive salaries (e.g. see Erin Roberts pay, which was increased again in 2016) of those same execs even though they haven’t shipped a single project, the money that should be going toward keeping the studios afloat, appears to be going to these same execs; even as they continue to hire inexperienced people at cheap rates, while more experienced and expensive people are leaving.

It must be noted that, even though we’ve known for some time that the crowd-funding chart was inaccurate (doesn’t take into account refunds, investor money, loans etc), the flow of the money, clearly shows periods during which they would be having cash flow issues if they were burning through approximately $3m (UK alone, as per 2016 filings, burned through about $2m of that) per month worldwide.

Also, despite having some EU pledge amounts being collected in the UK, the currency exchange rates makes it very costly for the US office to be the primary source of income for the UK studio which is burning through a huge chunk (approx $20m of the $36m raised in 2016) of their crowd-funding income. In a way, relying on the tax credits somewhat alleviates this burden; though it is hardly enough to sustain the studio.

In the past few months, rumors of layoffs, departures were floating around. Though quite a few people have since left, so far there is no evidence of any publicly announced layoffs. Not that it is something that CIG would publicize anyway. What should be of primary concern for backers is the fact that, 2017 is half over, the much touted 3.0 build (which was due out in Dec 2016, according to Chris Roberts), is over seven months late, and neither Star Citizen, nor Squadron 42, is on schedule for final release this year. And with the sheer amount of work left to do in Star Citizen, along with an unknown amount of work (backers have no idea about its status) attributed to Squadron 42, it’s anyone’s guess what is going to happen in the coming months. All I can say is that, if they are this desperate to take out a bad loan against future tax credits, then things must be dire. As someone aptly noted:

“CIG is borrowing money against future tax credits. And paying extra money (interest) for the privilege. The only reason a company would do that is if it could not wait for the tax credit because it didn’t have enough cash to make it to get to earning that next tax credit. This is similar to the company that is seeking to “smooth out” its revenue stream. But in the case of the normal company seeking to “smooth out” its income, it has “A REGULAR AND EXPECTED SOURCE OF INCOME.” CIG does not have this. CIG is looking to move future income (tax credits) into the present. Why is this bad? Because the tax credits are not ordinarily used as INCOME STREAMS! When a company is reduced to borrowing against tax credits, it is at the end of its life. Tax credits are not something a healthy company bases its income on. CIG is treading water and about to lose muscle control. This is bad, folks. This is the end. CIG, absent a miracle, won’t be here next time next year. “

2) As someone else pointed out.

“GBP has strengthen over the last bit, but USD is still quite strong. Unless they expect the GBP to materially fall, converting USD now will still buy a lot more GBP, and in turn British labor, than it would have a few years ago. If this were about f(x), they could manage currency risks through derivatives, which does not require collateralized lending. Maybe there is an angle I am not seeing as f(x) trading is its own discipline in finance, but the whole f(x) argument by Ortwin feels like a smokescreen. Pigs get fed, hogs get slaughtered.”

Also in this PCGamesN article comments:

“Question remains why they need such a small loan now (tax rebate is estimate below $5 million) and why they had to give the bank a floating charge and negative pledge. It’s not currency exchange rate, that is the biggest bullshit i ever heard because neither CIG nor the Bank knows how the pound will develop and it might even cost CIG more if the pound recovers.

Floating Charge means that from now on everything F42 UK does is covered as collateral even if it does not exist yet. They create a new ship, it’s automatically part of the collateral. Which extends to Star Citizen. The exclusion of Star Citizen is in name only (the IP).

Negative Pledge means that F42UK and parent company can not get any other loans. If for example CIG US would try to get a loan in the US and send money to CIG UK they would be in breach of contract and default on the loan.

This is typically only done for bailout loans. Never for a simple advance on tax were you typically only put up the tax credit as security and maybe a savings account.

The Bank obviously thought that there is a good chance CIG will not make it to the end of the fiscal year to get the tax rebate and therefor asked them to put up everything. This is a private Bank that knows when to make profit and it is pretty obvious that they have attached a very high interest rate on this and hope CIG will default“

3) A Redditor going by the name of OldSchoolCmdr, made some good points (1, 2, 3) about this whole thing. One that particularly stuck out, and which I hadn’t even thought of is related to why Star Citizen, the primary game, was listed in the “Excluded Collateral” list of the charge docs.

“The exclusion of “Star Citizen” is in name and IP only. This is why the “provisionally entitled” descriptor is important. If you read the previous sections and see how detailed the description of “Game” (which we can assumed to be Squadron 42), to include other assets such as code, audio etc, it is clear that all of the Game assets (tech etc) being used by both games, is a part of this loan.

The bank can’t take the Squadron 42 “name” – which has no value – and secure it as collateral. All the money that these companies have been getting, has come primarily from Star Citizen, not Squadron 42. If the bank walked into CIG in the case of a default, an administrator is going to be looking for any/all assets used in the creation of the SQ42 “Game”. There is no way that CIG is going to tell them that the source code – which is used in both games – is only for Star Citizen, and that SQ42 doesn’t have any separate source code of its own. That would give rise to “intent to defraud”.

What they have done here is carved out the “Star Citizen” name from the loan, thus allowing it to be abandoned and/or exploited (sold) by CIG if they so choose.

Outside of this loan, they could also sell the “Star Citizen” IP as-is, without having to attach source code (which now belongs to the bank via SQ42). In gaming we know that IP get bought and sold all the time, without any source code or assets attached. For example, see the listed sales for all Interplay IP. Another example is in the case of 38 Studios, they couldn’t sell the game’s IP (at bankruptcy) because there was no “game”, thus no tangible source code associated with it. The IP was thus worthless.

So the bank doesn’t own the “Star Citizen” name. But technically, by way of SQ42, they own everything associated and used to build it, in addition to any/all unique assets (e.g. mocap, music etc) that make up SQ42.

Here’s the kicker. Since the US parent is funding F42, any money coming from it – regardless of whether or not is it for SQ42 or Star Citizen – the bank is entitled to. Why? Because F42 is making both games – not just one. The bank doesn’t care because any/all assets (including money) are collateral.“

Given the legal implications of the above statement, and the notion that, if true, the bank may not have been aware of how these two projects are connected, I am not entirely in agreement (because I have no reason to believe that they would knowingly mislead the bank in this manner) with this synopsis.

Also, given the structure of these companies, the exclusion of Star Citizen could also be attributed to the fact that the UK studios may not have rights to that IP, or it was already pledged in another loan, and so they can’t pledge it as collateral. I mention this because the loan charge filing specifically excludes “US territory” rights as collateral. This means the “US territory” rights to Squadron 42 (referred to as “Game” in the charge filing), as well as the “worldwide” rights to Star Citizen, are excluded from the collateral pledge.

The sticky part in all this is compounded by the fact that, well, without the tech, assets etc used in Star Citizen, there is no Squadron 42. In thinking about that, one thing that springs to mind, as a game dev, is that they may have – on paper – licensed the Star Citizen tech to the UK studio for their use in Squadron 42. This is interesting because Foundry 42 is the studio that’s being funded to create both games, and it has the license to develop, sell, and distribute the games in question. In fact, thinking about it, this would probably explain why this loan charge is levied against both Foundry 42 and CIG.

At the end of the day, the exclusion of Star Citizen from this UK loan, just leaves the worldwide rights to that game, free and clear. However, since we don’t know anything about the financial state of the US operations, one has to wonder if they have in fact either leveraged the rights to both games, against loans taken here in the US, or are planning to do so in the future. I mention this because, in the case of this new loan, it excludes the first NatWest charge. Similarly, any pledged assets in other loans, would very well be excluded. And this would be the case of Star Citizen being excluded as collateral, if it was already pledged in another loan (it won’t be in the UK, as it would be public), or if they were planning on doing that at some point if they have to.

At the end of the day, if CIG had a history of being truthful and forthright with their backers, there would be no need for speculation about what is going on with a project that backers have poured over $150 million into. It’s almost as if releasing the project financials as promised in their ToS, would expose whatever it is they are hiding from backers.

UPDATE: 06/25/17:

Ortwin (Chris Robert’s long time business partner, and one of the officers) just posted an official statement on the company’s website. It reads:

This response has so many Red flags, I don’t even know where to begin. So, right off the top of my head…

1) Look at the 2016 filing, and it is 100% clear that the tax credits aren’t even going to fund 2 months of operations! I wrote an analysis of their 2016 filings which shows the tax credit amounts.

“They are now taking the tax credits awarded by the government for software companies in the region. For 2016, they took £3.3m ($4.1m) allowance, and with the £3.1m ($3.9m) taken in 2015, brings the total tax credit to £6.4m ($8.1m) thus far. Due to how this is calculated (after expenses), this tax credit adds approximately £6.4m ($8.1m) to the projects P&L calculations.“

2) That they took a loan against such a SMALL tax credit, should be troubling. If after getting $150m + investor money + loans, you also need to pledge ALL assets for a high-risk loan against a measly tax credit, that’s a problem. Not to mention a tax credit that is due in just a few months when they file taxes. But they apparently need the money right now. Why is that?

3) If this was just about the tax credits, why then is it not the ONLY collateral (p4 Section 4.2.9) listed? If true (given their record, this is highly unlikely), obviously the bank felt it was a risky loan because they could very well fold before being eligible for the tax credit. So they secured ALL their assets.

4) A UK tax credit, like here in the US, is a guaranteed asset, as long as your revenue is in compliance. You can take out a loan against just the tax credit, without putting your entire company and assets on the line – just for that. In this instance, this was not the case. The loan collateral isn’t just for the tax credit, but for highly valuable assets. Of course, as we’ve seen in the case of 38 Studios collapse (1, 2, 3, 4) over State tax credits, things can go sideways pretty quickly if you don’t plan correctly.

5) Also, Ortwin is the same guy who has been involved in various venture collapses, and complete loss of investor money; mostly in Germany. I wrote about this in my Money Laundromat blog a few months ago.

Further Reading:

Does a bank now own Star Citizen?

The Star Citizen Project Is In Financial Trouble